How to Match the Home You Buy to Your Pocketbook

Although buying a home almost always seems like a good idea, it is important to understand what homeownership involves before your biggest emotional and financial decision you'll probably ever make. Before setting off to view properties, step back and take a reality check and thoroughly prepare yourself to make a knowledgeable decision.

When people consider becoming homeowners, most of them immediately think of how wonderful it will be, but that "dream home" can easily become a nightmare when most of your money goes to pay the mortgage and there's little or nothing left over for other things you need or want. Meeting regular mortgage payments and other ongoing costs will tie up a lot of your cash, and can put considerable stress on your finances and your family life.

If you want to match the property you want to buy to your pocketbook, you will have to realistically assess all your needs, determine what you can afford and, usually, lower your expectations. Always keep in mind that overextending yourself financially is the quickest way to destroy the excitement of home ownership.

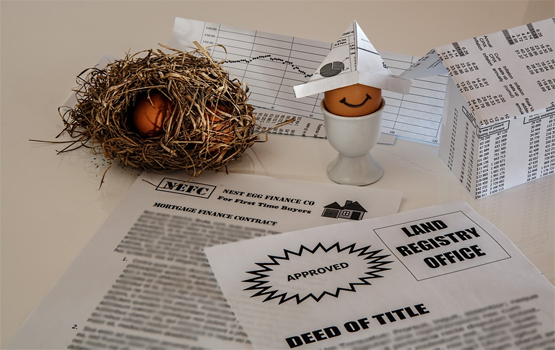

Informed home buying means knowing what you can afford and being practical about it. Most first time home buyers lower their expectations and decide to purchase a starter home, which is actually any property they can comfortably afford. A starter home is a good way to start your long term real estate investment.

If you decided that homeownership is right for you, now you need to determine if you are financially ready to buy a house. Use information and calculators provided on our web site to evaluate your current financial situation, how much house you can afford and the maximum home price that you should be considering.

Most property buyers lack the funds needed to buy a property without assistance from a bank or some other financial institution. Buying a property means combining your personal savings with money borrowed through a special arrangement called a mortgage. A mortgage is a security for a loan on the property you own. Mortgage is repaid in regular mortgage payments, which are usually blended payments. This means that payment includes the principal

Knowing your net worth, your current monthly expenses and your current monthly debt payments is very important because you will need this information when you discuss a mortgage with your lender. Your net worth is the amount left over once you've subtracted your total liabilities from your total assets. Typically, household expenses should not exceed 32 per cent of your gross income.

HELPFUL INFORMATION:

- Arranging Your Mortgage

- How a Lender Makes Decision About You

- Your Credit Score

- Your Down Payment

- How to Save for a Down Payment

- Goverment Programs Available for Home Buyers

- Get Preapproved for Mortgage

- Mortgage Calculators

- Mortgage Insurance

- FREE Reports and Articles

- Should You Invest In Property Inspection?

- Real Estate Glossary

- Real Estate Terminology

Buyer Info

Since choosing a right property to buy starts with needs and desires and finishes with a sizable portion of your earnings used for paying for it, it's important to ensure that the property you choose both meets your needs and is a good "fit" with your financial situation.

Read more...

Mortgage Info

Regardless of how certain you are that you will get mortgage, it is always good idea to get pre-approved from the mortgage lender of your choice. This will officially address any questions about your eligibility, rate, terms and it will enable you to better negotiate for the property of your choice.

Read more...